Fisher Equation Calculator Definition Formula & Examples

The Fisher Effect has been extended to the analysis of the money supply and international currency trading. During the temporary disequilibrium period of adjustment, an appropriate monetary policy can stabilise the economy. According to Fisher the price level is a passive factor which means that the price level is affected by other factors of equation, but it does not affect them. As detailed by Steve Hanke, Philip Carver, and Paul Bugg , cost benefit analysis can be greatly distorted if the exact Fisher equation is not applied.

But the classical economists recognised the existence of frictional unemployment which represents temporary disequilibrium situation. M Influences V – As money supply increases, the prices will increase. Fearing further rise in price in future, people increase their purchases of goods and services. Thus, velocity of money increases with the increase in the money supply . According to Fisher, the velocity of money is constant and is not influenced by the changes in the quantity of money.

Prices and interest rates must both be projected in either real or nominal terms. Stocks go up when inflation is high because they’re priced in dollars and you get more back for every dollar you invest. When inflation is subdued, stocks go down because their profits get diluted by lower prices for goods and services.

On contrary to fisher equation, the fisher effect states the real interest rate is same as that of nominal interest rate minus the expected interest rate. Therefore, real interest rates reduces as inflation increases, unless the expected nominal rate increases at the same rate as that of inflation. You are probably trying to understand the concept of Fisher equation. Through this blog article you will have a clear idea about what is Fisher’s equation, how Fisher’s equation is used and Pros and Cons of Fishers’ equation.

- Prof. Crowther has criticised the quantity theory of money on the ground that it explains only ‘how it works’ of the fluctuations in the value of money and does not explain ‘why it works’ of these fluctuations.

- In particular, progressivity and independence of the type of declaration, joint or separate, for married couples is analyzed.

- Alternatively, you can set one of the real interest rates and set either the nominal interest rate or the expected inflation rate.

You can approximate the real interest rate by subtracting the expected inflation rate from the nominal interest rate. The Fisher debt deflation is an economic theory formulated by Irving Fisher. In essence, it implies that a decreasing price level caused by the massive selling of financial assets increases the real debt burden in the economy, leading to a further rise in loan defaults and bank insolvencies.

It is not a piece of cake to manage the schedule keeping a healthy balance between a student's personal and academic life. Thus, the need for the best online assistance arises providing students with a helping hand. It contributes to sustainable development of the economy as it detects a situation where investors or lenders demand an additional reward. It is based on the assumption of the existence of full employment in the economy.

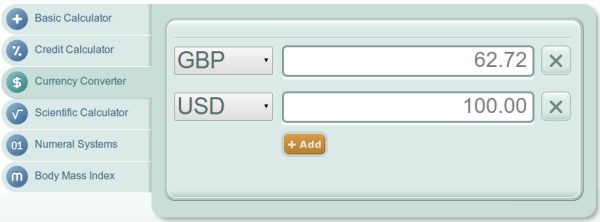

Fisher Equation Calculator

And we have considered this equation from the point of view of the theory of symmetry reductions in partial differential equations. Generalizations of the Fisher equation are needed to more accurately model complex diffusion and reaction effects found in many biological systems. The reductions to ordinary differential equations are derived from the optimal system of subalgebras and new exact solutions are obtained.

Find a positive effect of inflation expectations on nondurable spending in survey and household scanner data that lasts up to six months, though they do not detect a positive effect for durables. Similarly, using micro-data on inflation expectations, spending plans, and individuals' cognitive abilities, D'Acunto et al. Use MyAssignmenthelp.com’s Fisher’s equation calculator anytime you need to for instant results.

The Fisherian approach regards money as a flow concept; money is considered in terms of flow of money expenditures. The Cambridge version regards money as a stock concept; money supply refers to a fisher equation given stock at a particular point of time. We have many different methods to search for exact solutions of such equations. We have not got any method to look for exact solutions of such equations.

T is viewed as independently determined by factors like natural resources, technological development, population, etc., which are outside the equation and change slowly over time. Constancy of T also means full employment of resources in the economy. The fisher equation connects the relationship between real interest rates, nominal interest rates, and inflation. The Fisher Effect refers to the relationship between nominal interest rates, real interest rates, and inflation expectations.

Borrowing, lending and the time value of money

The money supply is the entire stock of a nation's currency and other liquid instruments that is in circulation at a given time. When the real interest rate is negative, it means the rate being charged on a loan or paid on a savings account is not beating inflation. The practical application here is that if an economy’s actual inflation rate exceeds expectations, the beneficiary is the borrowers at the expense of the lenders. The Fisher Effect describes how the real interest rate and the expected rate of inflation move in tandem. On the date that a financing arrangement is finalized, the inflation rate that will occur in the future is an unknown variable.

The Fisher effect refers to a relationship between inflation and nominal interest rates. In other words, it is the idea that each increase in inflation leads to an equal rise in nominal interest rates . In currency markets, the Fisher Effect is called the International Fisher Effect . It describes the relationship between the nominal interest rates in two countries and the spot exchange rate for their currencies. Various variables in the Cambridge equation are defined in a better and more realistic manner than those in the Fisherian equation.

Financial Analyst Certification

Higher interest rates do not imply a greater real burden on the firm if it's offset by a proportionately higher inflation rate. This is because the expected profits from the investment project will be higher in nominal terms. In other words, the greater return in money terms will offset the higher interest cost, leaving the real return unaffected. If you want to find the real interest rate, then take the nominal interest rate and subtract the inflation rate.

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Suppose a consumer has taken out a loan with an 8.00% fixed interest rate from a commercial bank. The most common measure of inflation is the consumer price index despite the criticism surrounding the methodology by which the index is calculated. Real Interest Rate → The interest rate adjusted for the effects of inflation . Under the equilibrium conditions of full employment, the role of monetary policy is limited.

A fall in the price level raises the real value of cash balances which leads to increased spending and hence to rise in income, output and employment in the economy. According to Patinkin, Fisher gives undue importance to the quantity of money and neglects the role of real money balances. Keynes in his General Theory severely criticised the Fisherian quantity theory of money for its unrealistic assumptions. First, the quantity theory of money is unrealistic because it analyses the relation between M and P in the long run. Thus it neglects the short run factors which influence this relationship.

The supply of money is assumed as an exogenously determined constant. Imagine two individuals write a loan contract to borrow P dollars at a nominal interest rate of i. This means that next year the amount to be repaid will be P × (1 + i). A real interest rate is one that has been adjusted for inflation, reflecting the real cost of funds to the borrower and the real yield to the lender.

What is the Fisher equation formula? Fisher equation derivation

A change in the quantity of money influences prices indirectly through its effects on the rate of interest, investment and output. Keynes’ fundamental criticism of the quantity theory of money was based upon its unrealistic assumption of fall employment. In a modern capitalist economy, less than full employment and not full employment is a normal feature.

If the real interest rate isn't affected, then all changes in inflation must be reflected in the nominal interest rate, which is exactly what the Fisher effect claims. Given a fixed interest rate, we can see that an increase in the nominal interest rate will bring down inflation expectations and prevent overheating. Similarly, a decrease in the nominal interest rate can increase inflation expectations, and spur more investment, thereby avoiding a deflation spiral. The variable K in the Cambridge equation is more significant in explaining the trade cycles than the variable V in Fisher’s equation.

Thus, the fundamental relationship among them can be determined by the nature of their work. But the purchasing power of money relates to transactions for the purchase of goods and services for consumption. In this light, it may be assumed that a change in the money supply will not affect the real interest rate as the real interest rate is the result of inflation and the nominal rate. It will, however, directly reflect changes in the nominal interest rate. But assuming that the nominal interest rate and expected inflation rate are within reason and in line with historical figures, the following equation tends to function as a close approximation.